Get an editable template of a memorandum of association for registering a company in Nepal here.

So, you are about to bring your dream company to life! Congratulations ! Your hard work, sacrifices, and struggles will certainly be worth it and it will eventually pay off.

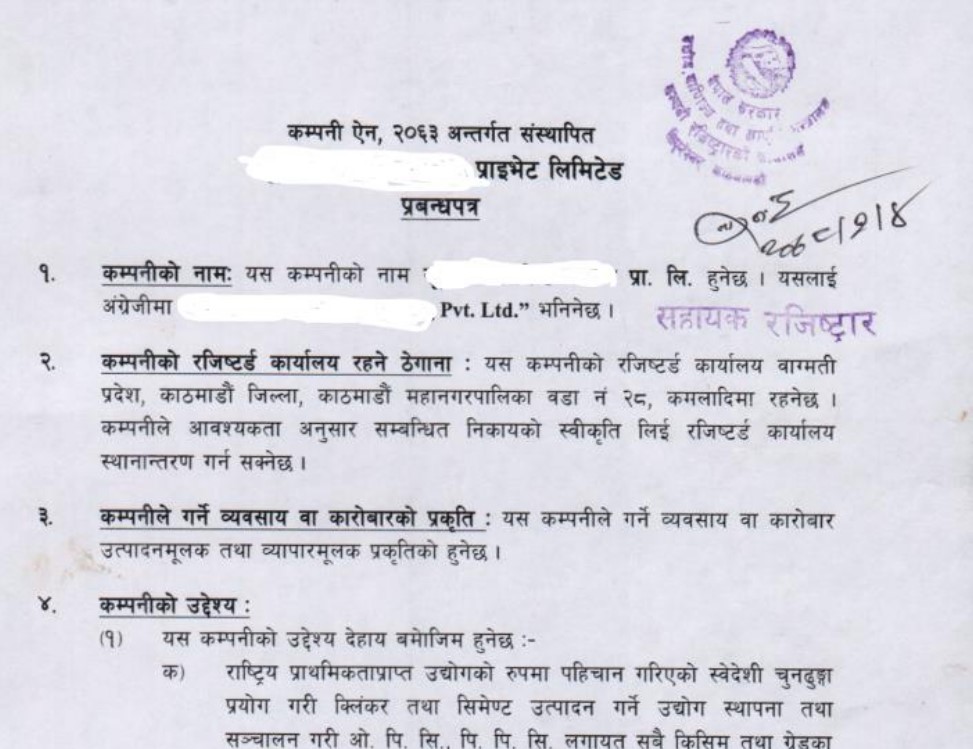

And now that you have decided to register your startup, we want you to help draft the constitution of your startup yourself. By the way, did we tell you that among various business structures available, a private limited company is ideal for startups? By now, we assume that you have already finalized the name of your dream venture and have already reserved the name. If not, you can do it online at the online portal of the Office of Company Registrar.

Once you have done this, the next stage, of course, is drafting the legal documents or writing the constitution for your startups. Yes, a memorandum of association is actually the constitution for your startup. Just like a constitution sets out the fundamental principles by which the country is governed, the memorandum of association also sets the fundamental guidelines to run the company. Have you given any thought on how you plan to prepare it or just want a lawyer to draft it for you? While there are templates available online, simply modifying an existing template may not lead to a well-crafted MOA. Therefore, prior to diving into the task of preparing a MOA, it's essential to understand what a MOA is and its significance.

What exactly is a memorandum of association, and why is a well-crafted one essential for your company?

The Memorandum of Association (also known as "MOA") is the constitution of the company that outlines the company's objectives, authorized share capital, and the rights and obligations of its members, shaping the company's relationship with the external environment. It defines the foundation of the company and establishes the legal framework for the business and defines the roles and responsibilities of shareholders and stakeholders.

Crafting a well-written MOA is crucial for establishing credibility and trustworthiness with investors, partners, and other stakeholders. It demonstrates that your company operates in a transparent and responsible manner, prioritizing the interests of all involved parties. As a result, a well-drafted MOA can bolster your company's professional image, emphasizing its commitment to operating with integrity and adherence to legal requirements.

If the MOA contains errors, ambiguities, or inconsistencies, it may not comply with the legal requirements for registration, resulting in the rejection of the application. Moreover, an insufficiently drafted MOA may result in legal disputes or other complications that could adversely affect the company's operations. Therefore, it is crucial to ensure that the MOA is meticulously prepared with a better understanding.

Preparation of a MOA

Now you might find the task of drafting a comprehensive and legally compliant MOA to be overwhelming due to the complexities and legal intricacies involved. Additionally, the cost of hiring a lawyer to assist in preparing a MOA can be substantial and may not be feasible for your start-up.

However, preparing a good MOA is crucial for your business. So, what is the solution?

To ease the burden for entrepreneurs, we have developed an editable template and guidelines on how to draft a MOA.

Our comprehensive guideline offers detailed and concise instructions on the legal prerequisites for creating an MOA. It provides an extensive and step-by-step approach to filling out each section of the MOA, ensuring legal compliance, clarity, and organization, all while saving time and money.

The following is a detailed guide on how to complete each section of your MOA.

Step-wise guideline to prepare a memorandum of association

1) Name of the Company:

The section includes the following elements and to help you understand better, an example has been incorporated alongside:

“यस कम्पनीको नाम सगरमाथा परामर्श सेवा प्रा. लि. हुनेछ । यसलाई अंग्रेजीमा “Sagarmatha Paramarsha Sewa Pvt. Ltd” भनिनेछ ।”

When filling in this section, it is essential to include the name of your company in both Nepali and English. However, when writing the name in English, it is important not to directly translate the Nepali name, as this may result in a different name. Instead, it must be ensured that the English name accurately corresponds to the Nepali name. For instance, as in the example above, your company is named "सगरमाथा परामर्श सेवा प्रा. लि” and the English name is "Sagarmatha Paramarsha Sewa Pvt. Ltd," not "Everest Consulting Service Pvt. Ltd.” It is crucial to exercise extreme caution in this regard, as a failure to ensure name correspondence may result in the rejection of your registration application.

2) Address of Registered Office of Company:

The section includes the following elements and to help you understand better, an example has been incorporated alongside:

“यस कम्पनीको रजिष्टर्ड कार्यालय बागमती प्रदेश, ललितपुर जिल्ला, ललितपुर महानगरपालिका, वडा नं. १ मा रहने छ । कम्पनीले आवश्यकता अनुसार सम्बन्धित निकायको स्वीकृति लिई रजिष्टर्ड कार्यालय स्थानान्तरण गर्न सक्नेछ ।”

When completing this section, it is necessary to provide the complete address of your company in the following order: province, district, municipality/metropolitan city, ward number. Please refer to the above example for guidance. Furthermore, it is also important to mention in this section that any changes to your company's address can only be made after obtaining approval from the Office of Company Registrar.

3) Nature of the business or transaction of the Company:

The section includes the following elements and to help you understand better, an example has been incorporated alongside:

“यस कम्पनीले गर्ने व्यवसाय वा कारोबार व्यापारमूलक /उत्पादनमूलक/ सेवामूलक प्रकृतिको हुनेछ ।”

In this section, you are required to disclose the type of your business and its transactions, specifying whether it is a service, trading, or product-oriented business, as illustrated in the example provided above. For instance, if your business operates a hospital, it is classified as a service-oriented business, while a business engaged in tea production would be considered a product-oriented business. If your company is involved in trading goods, then it would be categorized as trading-oriented.

4) Objective of the company:

The section includes the following elements and to help you understand better, an example has been incorporated alongside:

(१) यस कम्पनीको उद्देश्य देहाय बमोजिम हुनेछ ः–

क) परामर्श सेवा प्रदान गर्ने ।

ख) गाउँघरका केटाकेटीहरुलाई शिक्षा प्रदान गर्ने ।

In this section, it is necessary to list the objectives of your company, following the given example. The objectives should clearly define the purpose of the company's formation and outline the intended activities it plans to undertake. It's essential to draft the objectives in a concise and unambiguous manner, ensuring that they align with the type of business the company intends to conduct. The objectives should cover all aspects of the company's intended operations, including but not limited to production, trading, service delivery, investment, and other relevant business undertakings.

Furthermore, inaccurate or erroneous objectives may cause ambiguity and misconceptions regarding the company's purpose and intended operations. Furthermore, it can result in legal complications if the company engages in actions that do not align with its stated objective or attempts to alter the objective at a later stage.

5) Tasks to be carried on for the accomplishment of objectives of the Company:

The tasks required for achieving a company's objectives are generally similar across all companies. However, it is important to recognize that each company has its own unique objectives and requirements, which may necessitate adjustments to the MOA provisions by adding or removing some tasks. For instance, a manufacturing company may need to include tasks related to production, quality control, and supply chain management, whereas a service-based company may emphasize tasks related to customer service and innovation.

As a result, although the OCR's MOA template includes a standard set of tasks for accomplishing a company's objectives, businesses must carefully evaluate their specific needs and tailor the MOA provisions accordingly to ensure that they have the appropriate framework to achieve their objectives.

6) Structure of Capital of Company:

The section includes:

“१) कम्पनीको पूँजीको संरचना देहाय बमोजिम हुनेछ ः–

(क) कम्पनीको अधिकृत पूँजी रु. ५०,००,०००।– (पचास लाख रुपैँया मात्र) हुनेछ । सो पूँजीलाई प्रतिशेयर रु. १००।– का दरले ५०,००० (पचास हजार मात्र) थान साधारण शेयरमा विभाजन गरिएको छ ।

(ख) कम्पनीको तत्काल जारी गर्ने शेयर पूँजी रु. ३०,००,०००।– (तिस लाख रुपैँया मात्र) हुनेछ । सो पूँजीलाई प्रतिशेयर रु. १००।– का दरले ३०,००० (तिस हजार मात्र) थान साधारण शेयरमा विभाजन गरिएको छ ।

(ग) कम्पनीका संस्थापकहरुले तत्काल चुक्ता गर्न कबुल गरेको पूँजी रु. ३०,००,०००।– (तिस लाख रुपैँया मात्र) हुनेछ ।”

In this section, you will need to disclose your company's capital structure. Firstly, in number 1, you will need to disclose the authorized capital of your company, as well as the per share value of the capital. Secondly, in number 2, you need to provide the issued capital of your company, along with the per share value of the capital. Finally, in number 3, you will need to provide the paid-up capital of your company, as well as the per share value of the capital. The aforementioned example will give you an insight of it. The authorized capital is the maximum amount of capital the company can have and can range from as low as Rs. 1,00,000 to any higher amount. Please note that authorized capital is also an important factor based on which you will have to pay the registration fee to the Office of Company Registrar. So, if you have the authorized capital up to Rs. 1,00,000/-, then you will have to pay Rs. 1,000 as the registration fee. The amount of authorized capital depends on various factors like the initial investment from the promoters as well as the capital requirement of the company. The issued and paid up capital (initially the commitment from the promoters) is the amount that the promoters are willing to invest immediately (within a financial year). And both the amount should be equal.

Since, these amounts can be later increased, you don't need to worry too much about figuring the right amount and may specify an amount based on how much you would like to pay as registration fees or how much money you will be investing in next couple of years.

7) Types of Shares of Company:

The section includes:

यदि कम्पनीको शेयरलाई अग्राधिकार शेयर र साधारण शेयर मा बिभाजन सम्बन्धी कुनै व्यवस्था गरिएको छ भने

“ क) साधारण शेयर ः

(ख) अग्राधिकार शेयरः

कुनै व्यवस्था नभएको खण्डमा ः

क) कम्पनीले हाल साधारण शेयर मात्र जारी गर्नेछ । शेयर जारी गर्दा प्रचलित कानून बमोजिम गर्नुपर्नेछ ।

(ख) तत्काल अग्राधिकार शेयर सम्बन्धी कुनै व्यवस्था गरिएको छैन ।

(ग) हाल अन्य कुनै प्रकारको शेयर जारी गरिएको छैन । पछि साधारण शेयर बाहेक अन्य शेयरहरु जारी गर्नु पर्ने भएमा साधारण सभाबाट निर्णय गरी कार्यालयबाट स्वीकृति लिएर सोहि बमोजिम विभिन्न प्रकारका शेयर जारी गर्न तथा विभिन्न प्रकारका शेयरवालाहरुको अधिकार तथा शर्तका कुराहरु तोक्न सकिनेछ।”

In this section, you are required to indicate whether your company's shares are categorized as ordinary shares, preferential shares, or any other type. If there is a division of shares, you must specify the capital divided and per share value of each divided share. If there is no division of shares at present, you should mention that it hasn't been done yet, but may be done in the future, and a clear description of the rights and obligations of different types of shareholders associate with the type of share will also be provided after the decision of the general meeting and approval of the OCR. The aforementioned example can be referred to for better understanding.

8) Matters of restriction relating to subscription or Transfer of shares, if any: -

In this section, you need to indicate whether there are any limitations on the subscription or transfer of shares. Typically, the provisions outlined in this section are uniform across different types of companies and are provided in the Company Act, 2063 and can be obtained from the template provided by the OCR.

9) Payment of amount for shares: -

This section requires you to outline the procedure and timeline for payment of shares, in accordance with the Company Act, 2063. It is a default section that applies to all types of companies.

10) Maximum Number of Shareholders: -

Generally, the maximum number of shareholders is already mandated under Company Act, 2063. So, this provision is also similar for all types of companies. Furthermore, it is important to note that in case of employees who acquire shares through the provision of selling shares to employees, as well as employees who have purchased shares through this provision but are currently not employed, will not be included in the calculation of the maximum number of shareholders.

11) Liability to be limited: -

Under the Company Act, 2063, this section of MOA is standard i.e., similar for all types of companies and states that shareholders of the company are liable for its transactions only up to the maximum value of the shares they have subscribed or agreed to subscribe to. However, any contractual liability that a shareholder or director has assumed through a personal guarantee with a third party is exempt from this provision.

12) Other Essential Matters: -

In this Section, you may include additional provisions or requirements that are crucial for the operation or governance of the company but have not been covered in other sections of the MOA. These provisions are standard for all types of companies and can be obtained from the MOA template provided by OCR. However, you may add or remove provisions based on the specific needs of your company.

13) Any additional provision in accordance with the nature of the company:

If there are any other provisions related to the nature of the company that need to be included, you can list them in this section. Alternatively, if no additional arrangements have been made, you can indicate that by stating "no arrangements have been made."

14) Enforceability of Memorandum of Association in case of Amendment: -

This section is a standard provision included in the Company Act, 2063 and stipulates that any amendments to this Memorandum of Association will only be considered enforceable after a special resolution is adopted at the annual general meeting (for companies that hold general meetings) or a unanimous agreement is reached and recorded (for companies that do not hold general meetings).

15) Memorandum of Association to be inactive in inconsistency: -

This section is a standard provision included in the Company Act, 2063 and includes that if any inconsistency arises between the Memorandum of Association and the Company Act of 2006 or any other applicable law, the MOA will automatically become void to the extent of such inconsistency.

16) The number of shares the promoters have undertaken to subscribe immediately and declaration: -

In this Section, the promoters need to make a declaration that they are willing to establish a company and provide their name, address, signature, citizenship number and issued district the shares undertaken to be subscribed and the name, address, signature, citizenship number of the witness.

It is crucial to emphasize that the details included in this section must be precise and comprehensive since the document holds legal weight. Any inaccuracies or omissions could result in legal ramifications for both the company and its promoters.

Now that all sections of the MOA have been filled out, you may feel tempted to quickly submit the well-drafted MOA to the OCR . However, it is important to consider a crucial requirement that, if left unfulfilled, could result in the MOA being rejected by the OCR.

Other Important Considerations

Well, the requirement is to obtain the signature and fingerprint of the subscribers. The subscriber's signature and fingerprint are an essential component of the MOA and is mandatory under Company Act, 2063 as it indicates their endorsement to establish the company and their obligation to adhere to its rules and regulations. Furthermore, the signature serves as evidence that the subscriber has met their legal obligations throughout the incorporation procedure.

However, it is crucial for promoters to exercise extreme caution while signing and providing their fingerprints in the MOA, considering that it is a legally binding document. Even minor errors or inaccuracies in the signatures may result in legal complexities at a later stage.

How to sign a memorandum of association?

Promoters are required to sign at the bottom of the first page and both the top and bottom of the subsequent pages. Additionally, they must sign and provide a fingerprint in the designated table in the final section of the MOA.

Here is a tutorial in English on how should promoters sign the MOA of a company:

Here is a tutorial in Nepali on how should promoters sign the MOA of a company:

Finally, Your MOA is now complete and ready for submission. How was your learning experience? Quite overwhelming right ?

So, why not Book a Free Consultation Call with us! Also, don’t forget to share this to your friends who are starting up or own a business because sharing is caring.